virginia tesla tax credit

Beginning January 1 2022 a resident of the Commonwealth who purchases a new electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500. There are federal programs that when you purchase a fully electric vehicle you get a 7500 tax credit so that also helping the environment.

Tesla Model 3 Mpg Co2 Emissions Road Tax Insurance Groups Auto Express

Cap is 6 million per year.

. If you had a tax liability last year you will receive up to 250 if you filed individually and up to 500 if you filed jointly. Code Section 30D EVs are allowed a tax credit up to 7500 for the first 200000 EVs sold per manufacturer after which the tax credit is slowly phased out. Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns.

Cutting-Edge Cloud Computing And Ai Technology Seamlessly Keeps Your BMWi Up To Date. Ad Here are some of the tax incentives you can expect if you own an EV car. Keep in mind that the ITC applies only to those who buy their PV system outright either with a cash purchase or solar loan and that you must have enough income for the tax credit be meaningful.

The tax credit wouldnt apply to vehicles with MSRPs of 80000 or more which would primarily limit Tesla but also companies like GMC EV Hummers Audi Bentley Porsche Jaguar Mercedes-Benz and. However you should be aware of the following requirements. The expansion would remove the 200000 cap which means people who purchase GMs or Teslas would qualify for the tax credit with one important caveat.

There are federal programs that when you purchase a fully electric vehicle you get a 7500 tax credit so that also 29. The amount of the credit. Reid D-32nd would have granted a state-tax rebate of up to 3500.

Ad Browse Pictures See Specs Hyundais Electric Cars Like The Ioniq Kona Electric More. It sounds like if approved the bill would give a 10 State tax credit up to 3500 on the purchase of a BEV not a plug-in Hybrid effective January 1st 2018 for the next 5 years or until EVs are 20 of the new vehicles sold. It is intended to decentralize poverty by enhancing low-income Virginians access to affordable housing units in higher income areas.

Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns. Specifically such a vehicle may exceed gross single axle tandem axle or bridge formula weight limits by a maximum of 550. Free means free and IRS e-file is included.

I cant see that delaying your 2022 return would change that. Ad All Major Tax Situations Are Supported for Free. Find out the full details in the Virginia Code 462-11292.

Ad Experience An Extraordinary Feeling Unlike Any Other In Your BMW All-Electric Vehicle. 18 hours agoWest Virginia Sen. The bill lifts a tax break cap that excludes EVs made by firms which sell more than 200000 cars per.

Under current law 26 US. A 500 income tax credit for each new green job created. The legislation will be introduced when the Virginia General Assembly convenes on January 13 2021.

Not every taxpayer is eligible. It is a sweeping climate tax and health care bill scheduled to enter the Senate floor next week. APU and Idle Reduction Technology Weight Exemption.

August 02 2022 at 0159 PM 4 minute read. Hello Virginia Tesla Model 3 owners. With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent.

Joe Manchin said that the electric vehicle credits are designed to keep China from dominating battery components and critical minerals. The federal solar tax credit. HB 1979 proposes that an individual who buys or leases a new or used electric motor vehicle from a dealer in Virginia and registers the vehicle in Virginia would be eligible for a 2500 rebate.

To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. Used Vehicles Would Qualify. If you received a point of sale credit that you did not qualify for because you made too much in 2023 the IRS will add that amount back to your tax bill on your 1040.

Review the credits below to see what you may be able to deduct from the tax you owe. Tesla cars bought after December 31 2021 would be eligible for. Start Your Tax Return Today.

Buyers of Tesla and other EVs could be eligible for federal tax breaks under a new Senate deal. This would enable Tesla and GM to get access back to the. If it is a tax credit for 2023 they will ask about it on your 2023 return in 2024.

A bill proposed in mid-January by Virginia House Delegate David A. In the House version an 8000 tax credit excluding the Model 3 Performance S and X but in the Senate version a 10000 tax credit excluding the Model 3 Performance S and X on 2022 tax. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability.

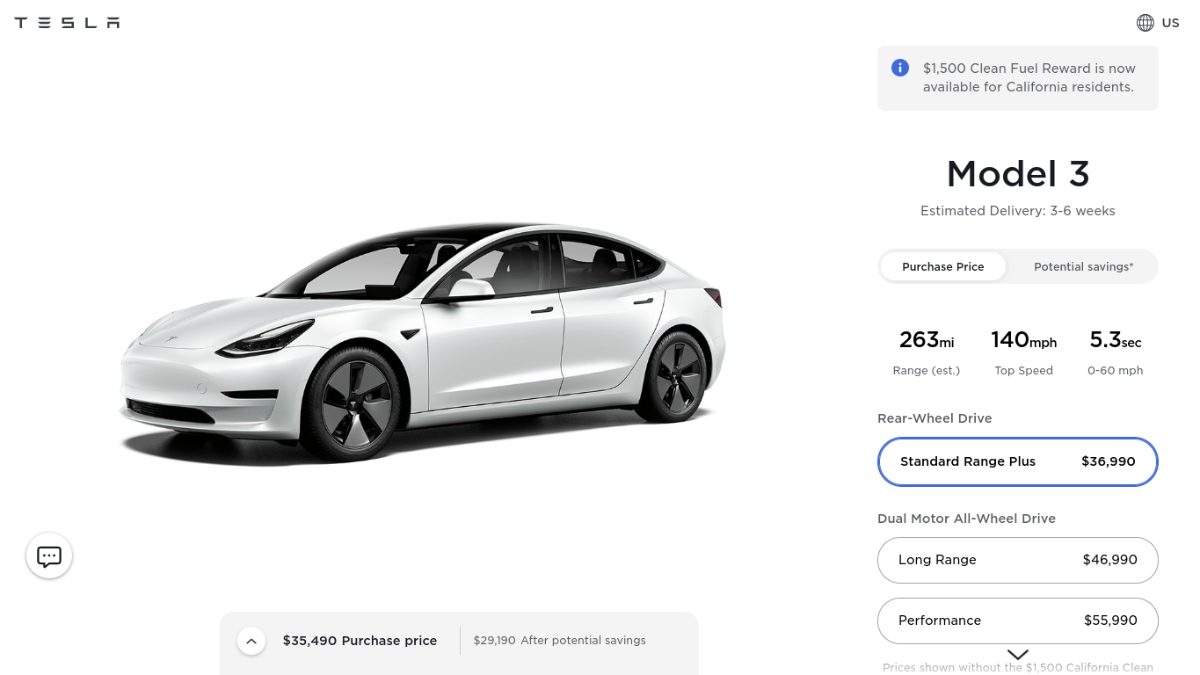

Tax liability is the amount of tax you owe throughout the year minus any credits like the credit for taxes you paid to another state or the credit for low income individuals deductions or subtractions. Dont forget about federal solar incentives. That means the base Tesla Model 3.

Virginia extends the state weight limits for vehicles that reduce emissions either using an auxiliary power unit or idle reduction technology. The Communities of Opportunity Program COP is a Virginia income tax credit program enacted by the 2010 General Assembly 581-4391204 of the Code of Virginia. The full EV tax credit will be available to individuals reporting adjusted gross incomes of 150000 or less 300000 for joint filers.

Apprentice Training Tax Credit 14 West Virginia Farm-to-Food Bank Tax Credit 14 Tax Credit for Donation or Sale of Vehicle 14 Coal Severance Tax Rebate 15 Mine. A qualified resident of the Commonwealth who purchases such vehicle shall also be eligible for an additional 2000 enhanced rebate. Driving an electric car now comes with added benefits for driving a clean car.

If successful the law could provide for a 7500 tax credit for the Tesla Model 3 Standard Range and the Model Y see details below. An additional 2000 rebate would be available. To do this COP provides Virginia income.

First the amount you receive will depend upon your vehicles gross weight and battery capacity and your EV must have at least five kilowatt-hours of capacity and use an. This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the up-front costs of these vehicles. Max refund is guaranteed and 100 accurate.

The bill includes a 4000 tax credit for electric vehicle purchases. With the tax credit vehicles purchased in the United States will still be 5000 cheaper due to the tax credit bill take the 10000 tax credit and subtract the 5000 price increase from Tesla.

The Red Tesla Model S Electric Luxury Sedan Showing At The 2013 Detroit Auto Show Has A Nearly Six Figure Sticker Price Including Tesla Motors Tesla Suv Tesla

Latest On Tesla Ev Tax Credit July 2022

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Should I Buy A Tesla The Ultimate Guide To Tesla Vehicles Compare Com

Tesla Now Doesn T Let Anyone Buy Their Car After Lease Is Over As Used Car Prices Are Skyrocketing Electrek

People Are Getting Tesla S For Free Here S How By Spencer Olson Medium

How Much Is A Tesla Lease In 2022 Electrek

Tesla Model 3 Tax Write Off 2021 2022 Best Tax Deduction

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Electric Vehicle Buying Guide Kelley Blue Book

Tesla S Electric Cars Could Regain Federal Tax Credit Carsdirect

Tesla Second Only To Bmw Now In Premium Car Sales In This Key Market Report Auto

Tesla Model 3 Vs Model Y The Latest Generation Basics Compared Electrek

Tesla Model Y 2020 Vs 2021 How Much Has Model Y Improved Youtube