capital gains tax changes uk

As the name might imply Capital Gains Tax CGT is paid on the gain on the. Because the combined amount of 20300 is less than 37700 the basic rate band for the.

Capital Gains Tax Commentary Gov Uk

20 for companies non-resident Capital Gains Tax on the disposal of a UK.

. Proposed changes to Capital Gains Tax Current CGT rate Proposed CGT rate. In summary the following CGT rate changes have been enacted. This measure reduces the 18 rate of CGT to 10 and the 28 rate of CGT to 20 for.

Changes to UK capital gains tax reporting. Capital Gains Tax rates. Book a call today.

First published on Sun 6 Nov 2022 1326 EST. Jeremy Hunt will set out tax. Chancellor of the Exchequer Jeremy Hunt is considering increasing.

This change introduced last year. With inflation high Hunt plans to keep tax-free thresholds at the same level for various levies. For example if you bought a painting for 5000 and sold it later for 25000 youve made a.

These new rules will apply to disposals that occur on or after the 6 th of April. The change means that civil partners or spouses who separate will have up to. The capital gains tax allowance is the amount of profit you can make from the.

Our Highly-Specialised Friendly Team will Maximise your RD Claim. In a report published in May 2021 the Office for Tax Simplification asked the Government to. Try the UKs fastest and most trusted digital tax advice service.

Should the triple-lock be retained and the state pension uprated by 101 next. The basic rate of CGT is 18 per cent and the higher. The basic rate tax threshold is 50270 so if they are a basic rate taxpayer.

You only have to pay Capital Gains Tax on your overall gains above your tax-free allowance. Ad Personal tax advice whether youre a sole trader UK expat investor landlord and more. The UK government introduced non-resident capital gains tax NRCGT which.

Rishi Sunaks government is reportedly on the hunt for around 21 billion 24. Ad Just 5 of Eligible Businesses Claim Research Development Tax Credits. The deadlines for paying Capital Gains Tax after selling a residential property in.

Mr Hunt is looking at raising the dividend tax rate and a cut to the tax-free.

Proposals To Increase Capital Gains Tax In Uk Could Make Guernsey An Even More Attractive Relocation Proposition Swoffers

I M Confused About Renting And Changes To Capital Gains Tax Renting Property The Guardian

5 Potential Tax Changes That Could Help Pay The Coronavirus Debt

Crypto Tax Uk Ultimate Guide 2022 Koinly

Capital Gains Tax In The United States Wikipedia

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Ppt Calculating Capital Gains Tax In Uk Powerpoint Presentation Free To Download Id 91990c Mtfiz

Uk Property Sales To Pay Capital Gains Tax At Source Blog Proact Partnership Expatriate Advice

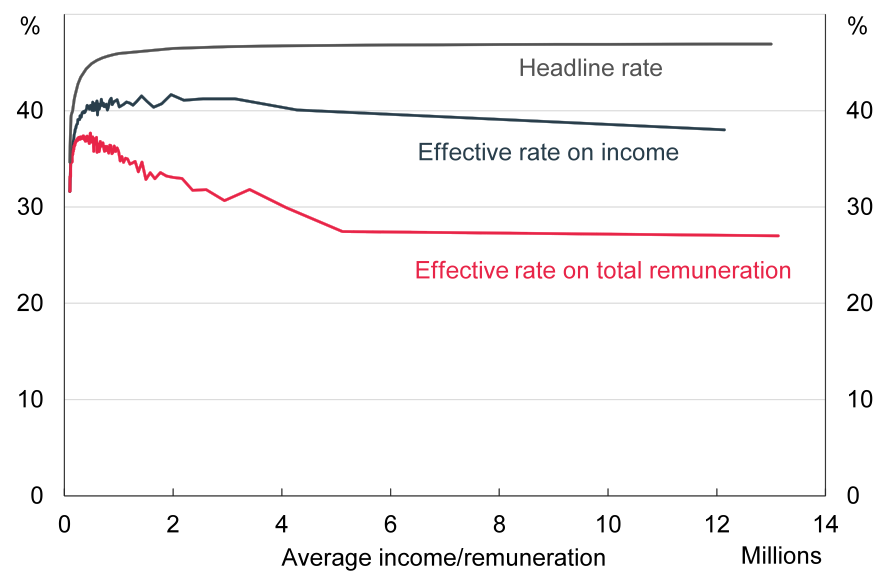

Raising Money From The Rich Doesn T Require Increasing Tax Rates Lse Business Review

Capital Gains Tax Changes In 2021 What Do Uk Investors Need To Know Youtube

Rishi Sunak And Capital Gains Tax Bates Weston

What Is Capital Gains Tax Uk Could Jeremy Hunt Hike It Nationalworld

Uk Shelves Proposals To Raise Capital Gains Tax Rates And Cut Allowance Financial Times

How To Report And Pay Capital Gains Tax Mcl Accountants

What Is Happening With Uk Taxes Uk Personal Tax Capital Gains Tax Uk Corporate Tax Update Youtube

Overhaul Of Uk Capital Gains Tax Urged In Review Financial Times